Mark Sherwill, based at the ConocoPhillips Canada office in Calgary, manages a commercial team responsible for the marketing and logistical oversight of liquid hydrocarbons produced by the business unit’s Surmont and Montney operations. Photo by Sarah Murdoch.

Mark Sherwill, marketing manager for the Canada business unit’s crude oil and natural gas liquids, plays a pivotal role in supporting the production portfolio of ConocoPhillips Canada. He started this assignment in December 2023, building upon his previous experience as manager of ConocoPhillips’ Singapore office and Asia crude oil marketing. In this Q&A profile, Mark discusses his professional growth, explains the responsibilities of the Calgary Crude & NGL Commercial team and shares his perspective on the dynamic Canadian energy landscape.

What path led you to Calgary?

For over 20 years, I’ve enjoyed an adventurous career with ConocoPhillips. While I've spent most of my time in Singapore in a commercial capacity, I've also had assignments in Dubai and as country manager in Timor-Leste. Having grown up in a rural farming environment in Australia, and now married with three daughters all of whom have a passion for the mountains, we feel incredibly privileged and grateful to have the opportunity to live and work in Calgary. Having said that, Singapore sets a high bar as a great place to live and work, with incredible colleagues and arguably the best food on the planet.

What does your new role in Canada entail?

The production portfolio of the Canada business unit is the largest I’ve had the opportunity to support. It includes a diverse and complex production and logistics profile across all transportation options, including pipeline, rail, marine and trucking. Taking on this role and being embedded in one of ConocoPhillips’ larger business units has been an exciting change. After several months in the role, with strong support from business unit and Commercial leadership and a highly capable and collaborative team within Commercial and throughout the business unit, I’m confident this assignment will be a career standout.

How would you describe the responsibilities and objectives of the Calgary Crude & NGL Commercial team?

The goal of our 11-person team is to understand and interpret local and global markets. This understanding informs our contracting strategies in support of flow assurance and helps us capture the full value of our equity production. Securing, operating and optimizing a dynamic range of contracted transportation, storage and facility assets are central aspects of our role and require close collaboration across the breadth of business unit functions and global Commercial. It’s exciting to be part of such an experienced, professional and high-performing team that contributes to the success of the broader business.

What are some of the challenges of the Canadian market?

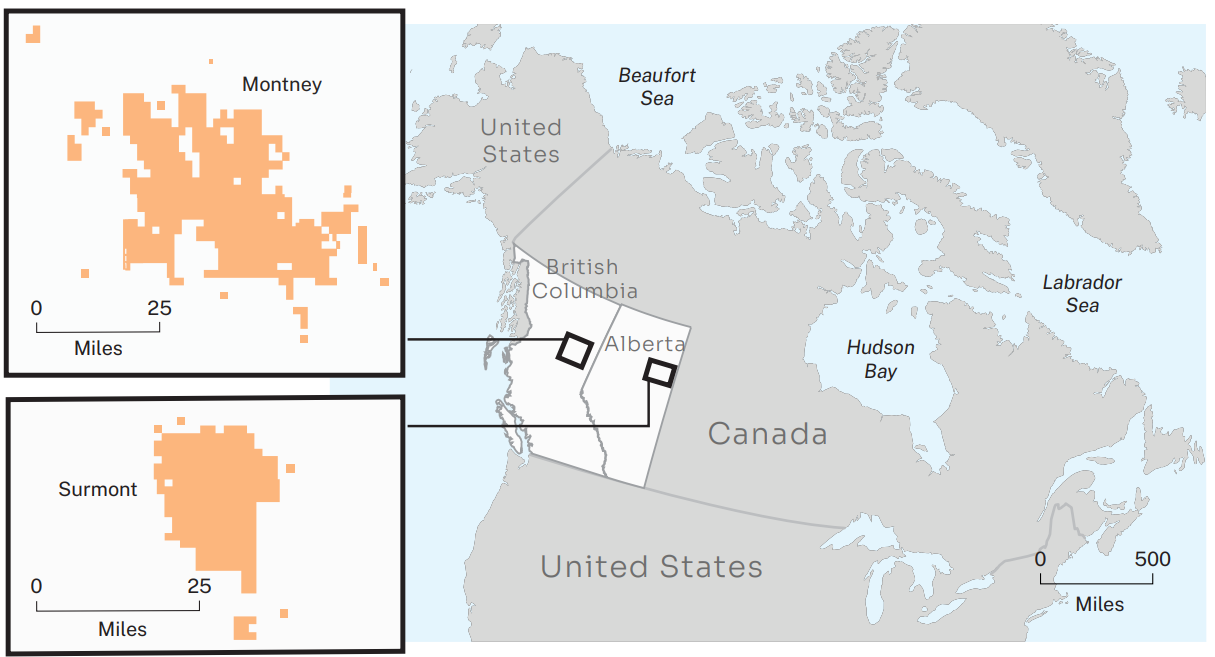

The nature of the Canadian market, where efficient/effective means for egress has been, and will again be, deficient, provides for a highly competitive environment that requires creative, long-term solutions. Alongside traditional pipeline channels that allow access to local and U.S. markets, the Diluent Recovery Unit (DRU)* contributes to our balanced portfolio, achieving safe egress and mitigation of market volatility.

*DRU technology separates diluent added to the bitumen in the production process, which meets two important market needs — it returns the recovered diluent for reuse in the Alberta market, reducing delivered costs for diluent, and it creates DRUbit, a proprietary heavy Canadian crude oil specifically designed for rail transportation.

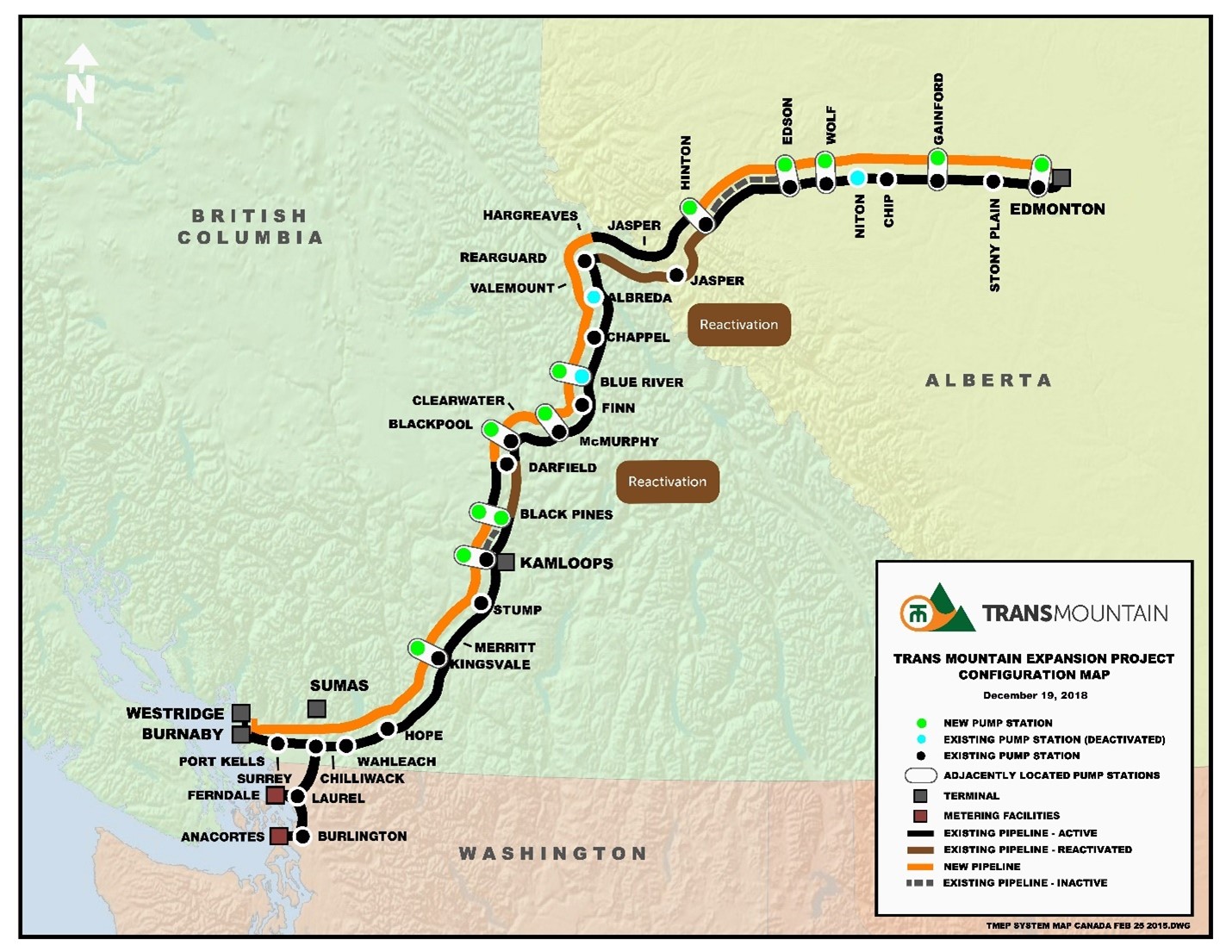

How has the Trans Mountain Expansion Project (TMX) changed the market?

Besides providing significant additional egress capacity for the Western Canadian basin, TMX also supports industry growth ambitions. Having a commitment on this project further enhances our portfolio approach and provides additional security to the strategic business unit plans. Surmont barrels now have increased access to international markets, providing an expanded customer base and diversified pricing. In addition to improved differentials for all our Surmont production, participating in this segment of the market provides our team with important sensitivity to global influences, sharpening our response to movements in the market.

Who is buying the crude oil that ConocoPhillips ships via TMX?

Our Surmont blend enters TMX as a commingled batch alongside other similar high-acid heavy crudes. We are marketing a new blended crude, currently known as Pacific Dilbit (PDB), from the Westridge dock.

The other nuance of this project is the draft limitations restricting offtake to Aframax size vessels. At the Westridge Marine Terminal, these crude carriers are limited to loading about 550,000 barrels of oil because of draft restrictions. This smaller size makes it harder to benefit from economies of scale on longer haul voyages to Asia. As a result, it remains uncertain which market will emerge as the preferred destination. We will have a clearer picture after several months of operation, once refineries have tested PDB within their crude slate and transportation efficiency has been explored by market participants.

In this regard, some companies are trialing transshipment of Westridge origin barrels to Very Large Crude Carriers (VLCCs) off the California coast. With the need for up to four Aframax transshipments to fill a VLCC, it remains unclear if the additional cost for transshipment will offset the rate improvement for such trans-Pacific voyages. With long-term success as the driver of our initial TMX strategy, our intention is to participate and understand the benefits and drawbacks of each potential opportunity, including delivery to the accessible markets.

What role does the Montney asset play in enhancing the company’s overall portfolio?

From a liquids perspective, our Montney facilities deliver crude, condensate, propane and butane each with nuanced quality and pricing and often with constrained transportation. Our condensate production provides direct and indirect support to a portion of Surmont’s diluent needs. The team’s collaboration with the facility operators and our pipeline and truck providers has been key to flow assurance and value capture. Ongoing teamwork with the asset development group will ensure we maintain preferential market access in support of our growth ambitions.

ConocoPhillips has a significant position in the Montney, an asset in northeastern British Columbia known for its liquids-rich resources. Above, workers at the Montney Central Processing Facility.